nh food tax rate

A 9 tax is also assessed on motor vehicle rentals. 1 those in New.

New hampshire does not have any state income tax on wages.

. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. New Hampshire Sales Tax Rate 2021.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. This set annually in October by the Department of Revenue. So the tax year 2022 will start from july 01 2021 to june 30 2022.

Starting october 1 the tax rate for the meals and rooms rentals tax. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. A 9 tax is also assessed on motor.

Brookfield had a population of. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

2022 Tax Rate Set. That is a decrease of 029 or 16. I ncorporated in 1794 the Town of Brookfield New Hampshire is located in Carroll County.

Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals. Meals paid for with food stampscoupons. New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

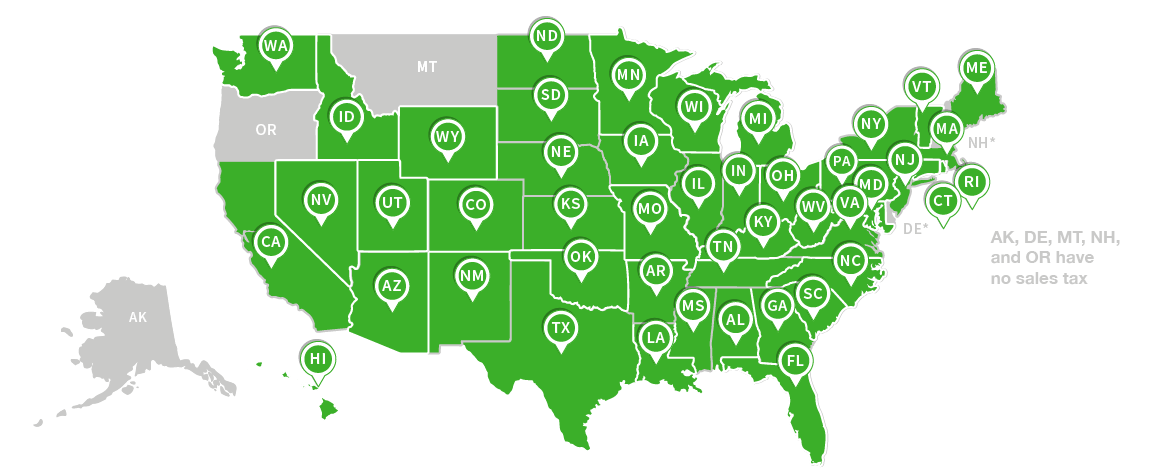

Exact tax amount may vary for different items. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. New Hampshire meals and rooms tax rate drops beginning Friday.

The NH Department of Revenue Administration has finalized the Towns 2022 tax rate at 1785 per thousand dollars of assessed value. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Total Tax Rate 2079. New hampshire meals and rooms tax rate drops beginning friday. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the.

Tax rate drops from 9 to 85. 2022 Tax Rate Established Brookfield NH. The current tax on nh rooms and meals is currently 9.

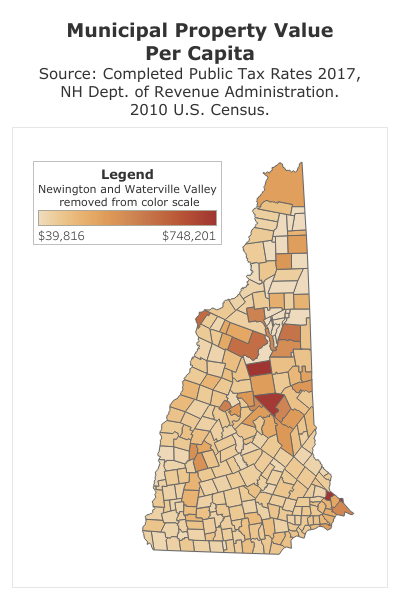

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. Meals paid for with food stampscoupons. So the tax year 2022 will start from july 01 2021 to june 30 2022.

New hampshire does not have any state income tax on wages. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The 2021 tax rate for Londonderry is 1838 per 1000. Motor vehicle fees other than the.

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

These Are The 10 Best Places To Live In New Hampshire

5 Sales Tax Questions Developers Should Ask Woocommerce Clients

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

Nh Families Continue To Fight Food Insecurity

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sales Taxes In The United States Wikipedia

Meals Rooms Rentals Tax Data Nh Department Of Revenue Administration

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

New Hampshire Cuts Tax On Rooms Meals To 8 5 Cbs Boston

Meals And Rooms Tax Nh Issue Brief Citizens Count

New Hampshire Income Tax Calculator Smartasset

New Hampshire Sales Tax Handbook 2022

Time To Cap Commissions On Nh Meals And Rooms Tax

New Hampshire Sales Tax Rate 2022